How to Write an Apple App Store Description

Posted on July 17th, 2024

Learn how to approach App Store descriptions the right way so you can effectively engage and convert users.

If I told you there was a user acquisition channel that:

.... it would be crazy to attempt to go after this channel with unrelated data, with tools that are not built for the job. What if your competitors have identified and invested in enterprise-quality App Store SEO tools and your team has not?

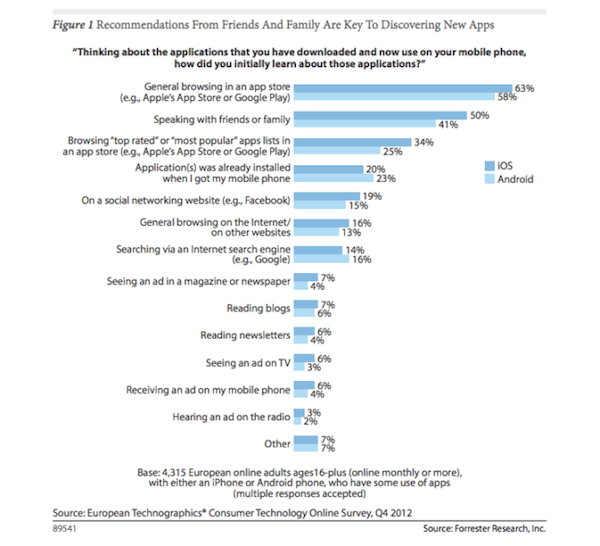

It is estimated by several sources that search and browsing makes up at least 50% of mobile app downloads. Neither Apple or Google release this data, but various polls show mobile app discovery is still driven by searching the app stores.

For the best monetizing mobile apps, their LTV>CPI spread is large enough that almost every possible user acquisition channel from TV Ads to Outdoor advertising works for them. Looking at top grossing for today - 20 of the top 25 are Gaming Apps, with 3 of the other 5 subscription-based apps (Pandora, Spotify, Match, Zoosk). Your app is competing for paid users with these guys. But not likely competing with them in search results.

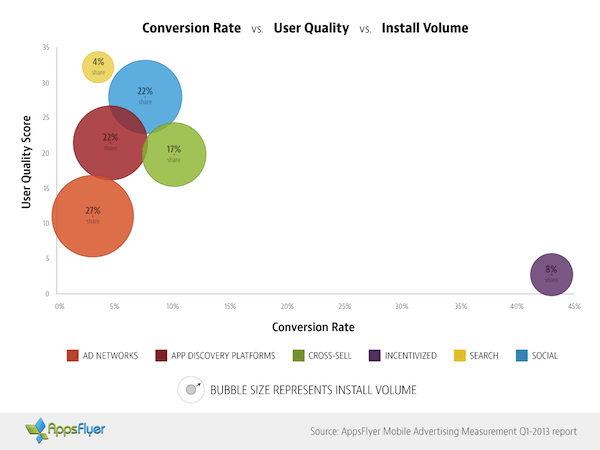

According to an Appsflyer study - the user acquisition channel with the highest user quality (measured by app opens) was search.

App Store SEO

is the process for positioning an app for discovery by these user searches. But several ASO keyword tools are using web data to show traffic, related keywords and suggested keywords. If you are frustrated with your mobile app store optimization efforts, or wonder how other mobile apps are getting so many organic downloads - using an ASO service that leverages web data could be the issue.

App Store SEO

is the process for positioning an app for discovery by these user searches. But several ASO keyword tools are using web data to show traffic, related keywords and suggested keywords. If you are frustrated with your mobile app store optimization efforts, or wonder how other mobile apps are getting so many organic downloads - using an ASO service that leverages web data could be the issue.

For starters - let's look at how people search the web versus how people search on a mobile device.

Search Queries

According to moz.com there are 3 different search queries users generally perform:

1. “Do” Transactional Queries- Action queries such as buy a plane ticket or listen to a song.

2. “Know” Information Queries- When a user seeks information, such as the name of a band or the best restaurant in the area.

3. “Go” Navigational Queries- Search queries that seek a particular online destination, such as Facebook or a homepage of a sports team.

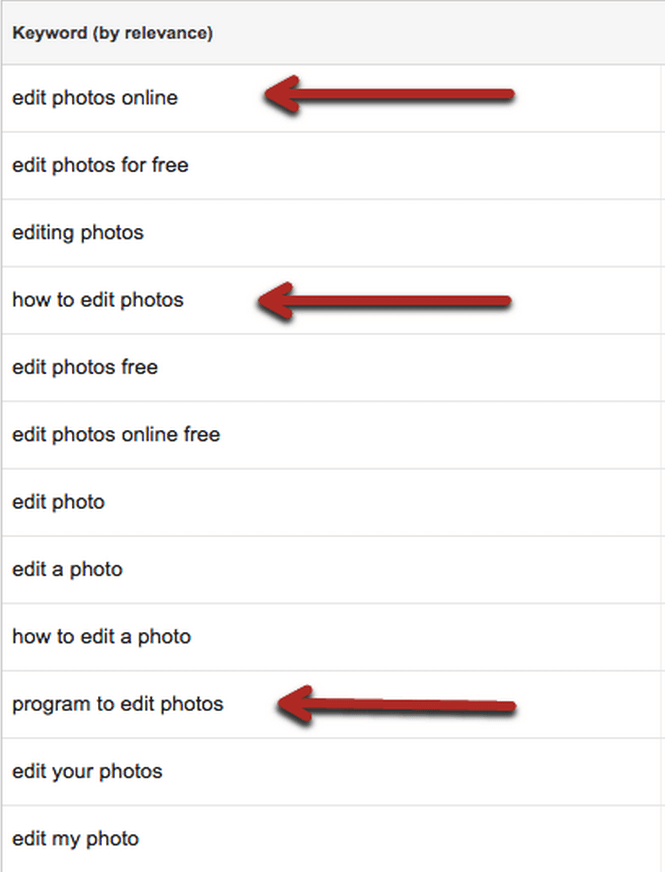

A search with the Google Keyword Planner for "edit photos"

shows these results as being the most relevant:  As you can see web search results from the Google Keyword Planner fall into the 3 different types of web search queries.

As you can see web search results from the Google Keyword Planner fall into the 3 different types of web search queries.

1. “Do” Transactional Queries- “Edit photos” or “Edit photos online”

2. “Know” Information Queries- “How to edit photos”

3. “Go” Navigational Queries- “Program to edit photos”

Google Keyword Planner seems to confirm moz.com's framework for web search.

According to data Gummicube has collected from mobile users since 2011, “80% of all search queries in the app store are 2-3 word phrases related to app features.” The balance is generally 1 word app/brand name searches.

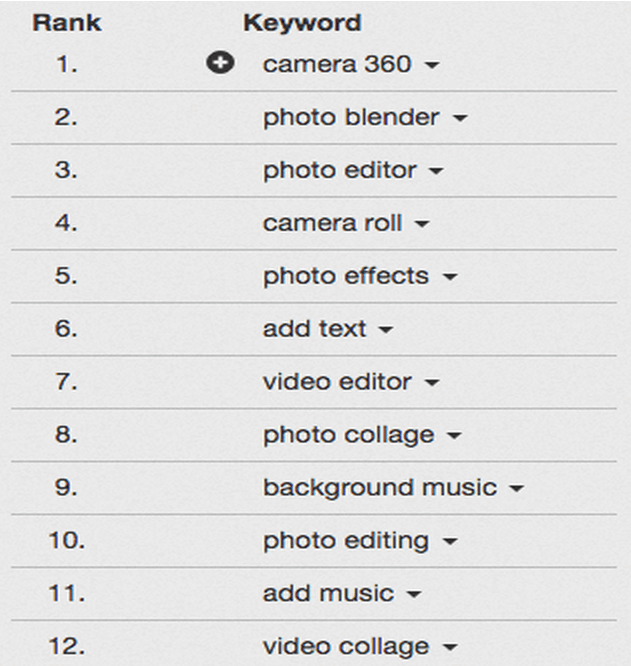

So how are users searching for mobile apps on their device? Using our software Datacube, the results for the same search term edit photos:  So for the same query using mobile search, you can see the results are feature and brand based:

So for the same query using mobile search, you can see the results are feature and brand based:

Does the ASO or keyword tool you use to target keywords, phrases and features provide volume estimates? I am sure I am breaking some internet rule posting two memes in one post - but I just figured these out and I think they hammer the point home...

I am sure I am breaking some internet rule posting two memes in one post - but I just figured these out and I think they hammer the point home...

Can't optimize for maximum exposure in the app stores....

...to acquire valuable, relevant organic installs....

...trusting your efforts to tools that are designed using the wrong data.

If you are using any “ASO Tool” which relies on web based search data then you are using the wrong dataset.

Mobile App Store Optimization

Successful Mobile App Store Optimization relies on understanding user behavior when searching the app store. Web search and mobile search are not the same. Mobile search data from Gummicube is the most effective way to find relevant and trending keyword phrases. Search provides one of the most cost-effective user-acquisition channels available to mobile app marketers.

Want More Data-Driven, Mobile App Marketing Content?

Learn how to approach App Store descriptions the right way so you can effectively engage and convert users.

Learn how to grab your audience's attention through effective and engaging app store preview videos.

Welcome to this week’s ASO Weekly - The App Store halts gambling ads amidst outcry and the Apple takes a bite out of NFT app sales.